BLOG

Stay up to date with the latest tax updates, legislation changes and industry news from around the globe.

Seeking True North: How to Manage The Challenges of International Withholding Tax as an Investor

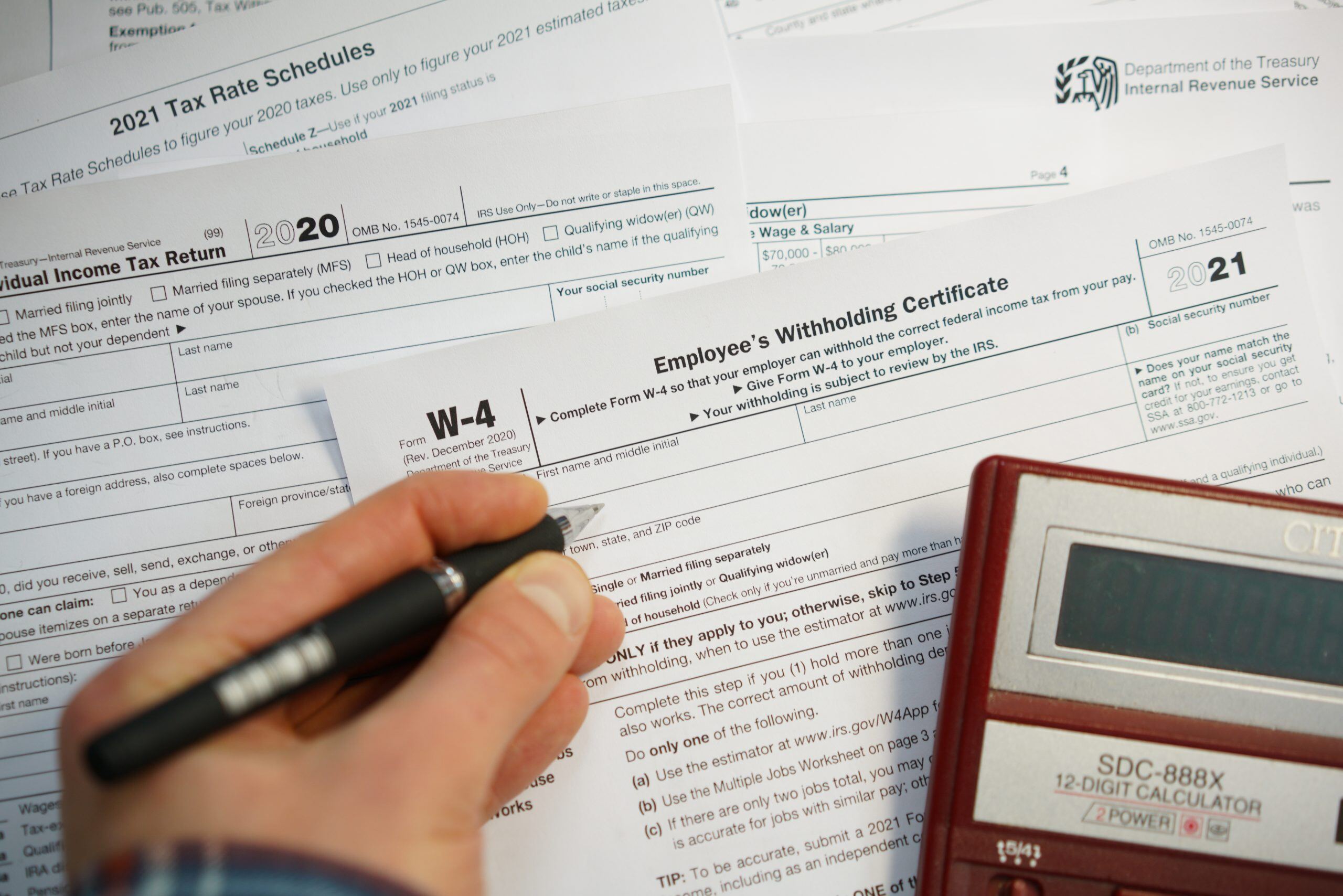

Cross-border taxation is complicated at the best of times. However, harnessing the refund opportunities embodied in taxation legislation can be even more daunting for any investment firm’s finance team.

Denmark Denies Dividend Withholding Tax Refunds to Foreign Investment Funds Pursuant to Recent Supreme Court Ruling

Overview and Case Outcome The much-anticipated Danish Supreme Court judgement in respect of the Fidelity Funds Case (Case 59/2019) was finally handed down on 24 June 2021. The main question posed in the Fidelity Funds case was whether it is in line with EU law that foreign investment funds suffer withholding tax on dividends distributed from Danish shares, while Danish resident investment funds which have elected to be taxed under section 16C of the Tax Assessment Act (TAA) (often referred to as “investment funds with minimum taxation”) are exempt from tax on Danish-sourced dividends.

Contractual Finnish UCITS Ruled Comparable to Corporate Luxembourg SICAV by CJEU

A judgement rendered by the Court of Justice in the European Union (CJEU) on 29 April 2021 in case C-480/19 – Veronsaajien oikeudenvalvontayksikkö (Revenus versés par des OPCVM) (“C-480/19”), could help non-Finnish corporate form investment funds (such as Luxembourg SICAVs) justify their eligibility for preferential Finnish withholding tax treatment going forward. Unlisted Luxembourg SICAVs have suffered unfavourable withholding taxes on Finnish sourced dividends for many years, but a new CJEU ruling could be the start of full withholding tax recovery for corporate-form investment funds.

Foreign Withholding Tax Reporting: Why Access, Transparency and Expertise are Key

Access to WHT Reclaim Reporting As an investor, the importance of optimizing foreign withholding tax (WHT) recoveries cannot be overstated. Reducing tax drag has an appreciable effect on investment performance, even more so if the reclaimed funds are reinvested over an extended period.

The Only Constant is Change: The Latest Trends in WHT and WHT Recovery

It’s often said that the only constant in life is change, and that the only certainties are death and taxes. Withholding tax on investment income is undoubtedly one of these certainties, but the industry is on the cusp of momentous shifts in the way taxes are levied, recovered and tracked.

What You Need to Know About Proposed Changes to Danish Dividend Withholding Tax Law

Recently proposed amendments to Denmark’s tax laws are expected to rectify the discriminatory withholding tax treatment of certain comparable Danish and foreign entities.

Everything You Need to Know About Double Tax Treaty Withholding Tax (WHT)

Understanding the Basics of Double Taxation on Investment Income Put simply, double taxation occurs when two countries tax the same income.

Is Hong Kong the World’s Next Fund Hub?

In February 2021, Hong Kong’s Financial Services and The Treasury Bureau (FSTB) issued a proposal for easier migration of foreign funds to Hong Kong, in order to encourage more locally domiciled funds and thereby boost the investment market in Hong Kong.